If you start playing a game before you bother to learn the rules ... you will lose!

| Home | Stock Market Barometer | "TT-NT" Stock Rankings | Trading Boot Camp | Support |

|---|

Trading Tools that have proven to ACTUALLY WORK !!

____________________________________________________________

Stock Market BAROMETER

If you're looking for something to help you know WHEN to enter and exit your stock positions, then honestly:

This is THE BEST indicator we've ever seen for signaling the start of Bullish and Bearish trends in the Stock Market!!

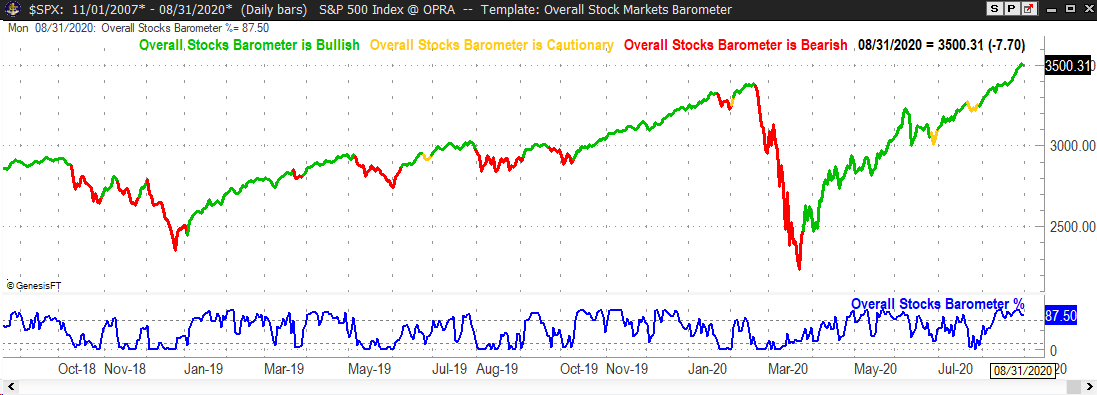

As you can see, this is a "leading" type of indicator (rather than "lagging"), often signaling big downturns just as they begin.

This forecasting indicator acts like a "Barometer", measuring the various pressures on the stock market based on 20 different

long-term and short-term inter-market relationships (e.g. stocks, bonds, gold, high-yield debt, new construction, etc).

And with the new "Overall Stocks Barometer", knowing exactly WHEN to enter and exit has never been easier!

Here are the ONLY STEPS you really need to follow:

1. Simply use the "Overall Stock Markets Barometer" chart template with any stock index symbol (e.g. $SPX, $COMPQ, etc).

2. When the price color turns GREEN, you should enter your stock positions with 100% of your available stock portfolio.

3. When the price color turns YELLOW, you should only be in your stock positions with 50% of your available stock portfolio.

4. When the price color turns RED, you should exit all your stock positions (i.e. just hold in cash until the market turns).

Wouldn't you like to have exited your stocks right at the very beginning of the "Pandemic Downturn"!

____________________________________________________________

The STORY behind how this tool was created:

Wow, this whole Coronavirus pandemic sure put the markets through quite the roller coaster!

The stock market had NEVER before entered a “recession” (by a strict technical definition) so quickly, and then recovered again so quickly!

And yet, in practical terms, all this volatility was more of a “temporary gigantic blip” (due to a health crisis) rather than a true recession

(based on a financial crisis). So this stock market roller coaster certainly caught me off guard … and most likely you as well?

But honestly, simply due to the unparalleled nature of this kind of historic event, I found myself basically just having to ignore my

normal "stop rules” and decided just to navigate my exit and entry points by the seat of my pants … and fortunately, it did work out

very well for me. But in hindsight, this simply made me feel “lucky”! And since I do NOT like trading that way, it motivated me to

work on developing a timing tool which could MUCH BETTER help forecast the true Bullish and Bearish trends in the stock market.

Well, after a lot of research and testing, I discovered the real “key” to unlocking the puzzle:

the best type of predictive timing tools use the concept of Intermarket Relationships -- but whereas the

average trader may typically just use one, the big-time “quants” do their analysis by combining a lot of them!

So I went to work, and eventually ended up with 20 different short-term and long-term intermarket relationships

(e.g. stocks, bonds, gold, high-yield debt, new construction, etc), each of which indicates either bullishness or bearishness for the

overall stock market. Then I combined them all into a single indicator as a measure of the overall Bullish vs. Bearish PRESSURE

being put onto the stock market -- which is what led me to name this new indicator the “MARKET BAROMETER”.

____________________________________________________________

The "Market Barometer" library, which can be easily imported into the Trade Navigator platform, includes ...

1. Market Barometer % indicator (lower pane of chart):

Comprised of 20 different long-term and short-term ratios of various intermarket relationships (e.g. stocks vs. bonds,

stocks vs. gold, high-yield bonds vs. treasury bonds, growth vs. utilities stocks, new construction rising/falling, etc.),

each of which indicates a measure of either bullish or bearish pressure in the overall stock market.

The indicator provides a total percentage score based on the current projected bullishness of the overall stock market

(where 0% = all intermarket ratios being bearish, and 100% = all intermarket ratios being bullish).

2. Bullish and Bearish Market Barometer highlight bars (upper pane of chart):

The highlight bars will color the data either green or red to indicate whether the Market Barometer is signaling

either overall Bullish or Bearish pressure. The Bullish/Bearish signal primarily uses the Market Barometer % values,

but in a very unique way which combines both the current level and direction of the Market Barometer,

as well as the direction of the current price movement, in order to eliminate a lot of premature signals.

3. "Market Barometer" chart template:

You can easily apply this template to your chart to duplicate the sample charts with both of the above indicators.

And while the above indicators can be used on individual markets, the Market Barometer was really primarily designed for

the overall stock market by using data from one of the major stock indexes (e.g. $SPX, $COMPQ, $DJIA, $RUT, etc).

And towards that purpose, the following "Overall Stocks Barometer" indicators have been recently added, which are all

calculated based on both the $SPX and $COMPQ (and thus provide the same values regardless of the symbol being charted) ...

4. Overall Stocks Barometer % indicator (lower chart pane):

This indicator is simply the average of the Market Barometer % for both the $SPX (S&P 500 index) and

the $COMPQ (Nasdaq Composite index), to help provide a better indication of the stock markets as a whole.

5. Overall Stocks Barometer is Bullish/Cautionary/Bearish highlight bars (upper chart pane):

*** This is the primary indicator to determine how much of your portfolio should currently be invested in stocks ***

These highlight bars will be GREEN if the standard Market Barometer is Bullish for both the $SPX and $COMPQ,

but will be YELLOW if the standard Market Barometer is Bullish for either $SPX or $COMPQ but not both,

and will be RED if the standard Market Barometer is Bearish for both the $SPX and $COMPQ.

6. "Overall Stock Markets Barometer" chart template:

You can easily apply this template to your chart to duplicate the sample charts with both of the above indicators.

FYI: The Market Barometer indicators are designed primarily for daily bars, but can also be used with weekly bars.

The indicators calculate values back to early 2008 (since a key intermarket component only has data back that far).

____________________________________________________________

We've seen many inferior indicators trying to predict bullishness/bearishness selling for over $100/month.

But for a LIMITED TIME, you can get both the Market Barometer indicator and Bullish/Bearish

Highlight Bars at the Introductory price of LESS than $40 per month!! (as an annual subscription)

| For purchase information, call Trade Navigator: (719) 262-0285 |

So here’s trusting you find the “Market Barometer” to be the BEST timing tool you’ve EVER used

for knowing when to Enter and Exit (or begin scaling into and out of) the stock market with your portfolio!!

____________________________________________________________

For questions or support with products, please send an email to: TradeByTheRules@gmail.com

U.S. Government Required Disclaimer: Stock, Options, Futures, and Forex trading is not appropriate for everyone. While there is a potential for large rewards,

there is also a substantial risk of loss associated with trading. Losses can and will occur. Don't trade with money you can't afford to lose. This is neither a solicitation

nor an offer to buy/sell stocks, options, futures, and/or currencies. No system or methodology has ever been developed that can guarantee profits or ensure freedom

from losses. No representation or implication is being made that using these methodologies or systems will generate profits or ensure freedom from losses.